Disclaimer: The content of this article does not provide any guarantee of returns. The steps taken by you using this details are strictly at your own risk.

The Mutual Fund is one type of investment product in which the money of many investors is pooled. Mutual Fund basically focus on the best use of funds taken from investors and reaching the investment goal. Here is the best 5 mutual funds in India in 2020 which can be seen for the best returns.

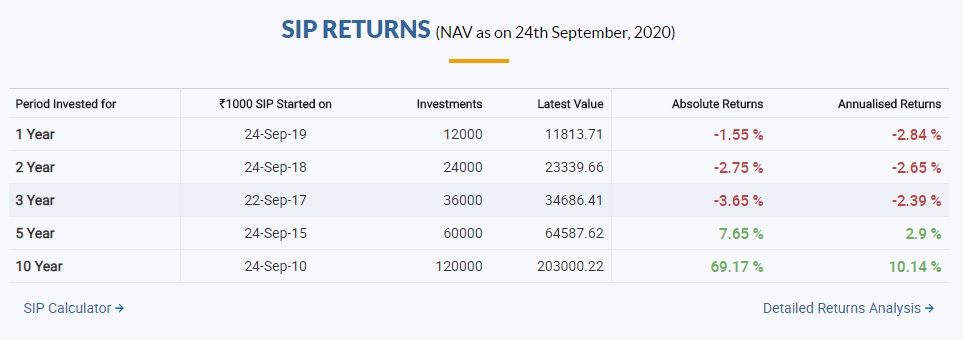

1. Mirae Asset Large Cap Fund

- Net assets Value (NAV) of Mirae Asset Large Cap Fund is Rs. 49.314 (24th Sept.2020).

- This is a large cap fund with the size of Rs. 18385.69 Cr and Expense Ratio of 1.71%.

- This Fund is having 98.4% investment in Indian stocks out of which 69.83% is in large cap stocks, 13.68% is in mid cap and 2.76% is in small cap stocks.

- Rest of 1.6% is MF Units (0.70%), TREPS (0.48%), Net Receivables (0.42%),

- This fund is suitable for those investors who are looking for investing money for at least 3-4 years. However, investors must be ready to moderate possible losses in their investment.

|

| Image(Screenshot) from Moneycontrol |

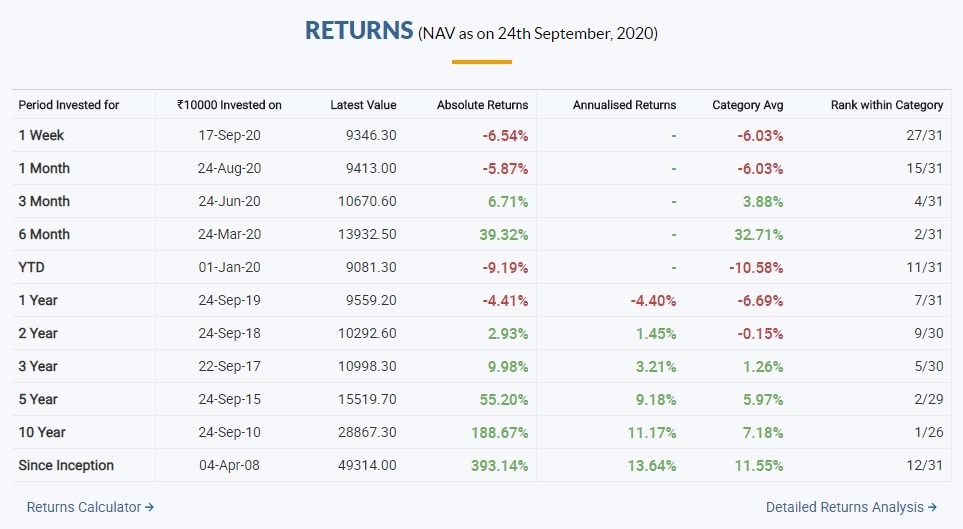

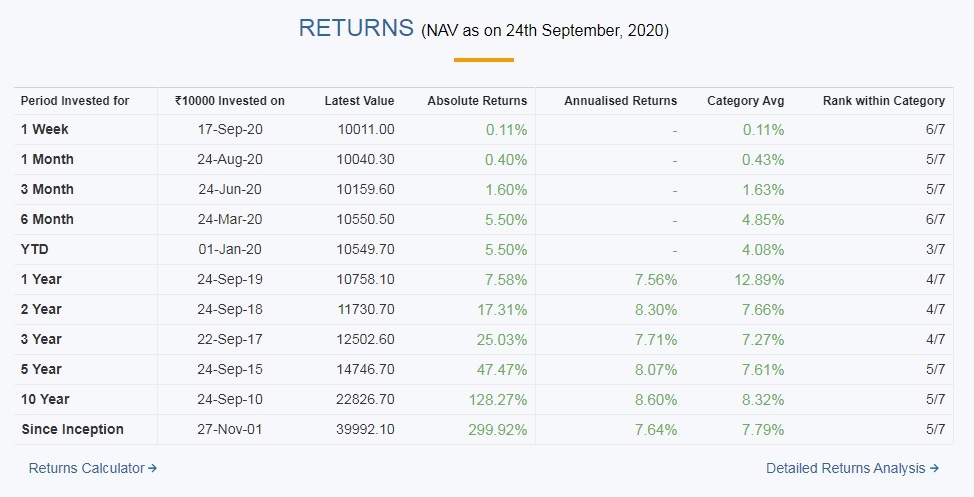

2. Aditya Birla Sun Life Saving Fund

- Aditya Birla Sun Life Saving Fund is a short term fund

- Fund House : Aditya Birla Sun Life Mutual Fund

- Net Asset Value (NAV) of this fund is Rs. 399.9209 (24th Sept.2020) and size of the fund is Rs. 16218.25 Cr

- This fund is having 96.1% investment in Debt out of which 15.25% is in Govt. Securities, 80.9% in funds which are invested in very low risk securities.

- Rest of 3.9% is Net Receivables (1.99%) and TREPS (1.91%).

3. SBI Magnum Multicap Fund

- With the Net Asset Value (NAV) of Rs. 44.6917 (24 Sept.2020), SBI Magnum is a multicap fund by SBI Mutual Fund with the size of Rs. 9063.31 Cr.

- This multi cap fund has 98.17% investment in Indian stocks, out of which 65.07% in large cap stocks, 10.69% in mid cap stocks, 11.72% small cap stocks.

- Rest of 1.83% TREPS (0.85%), Net Receivables (0.54%) and Margin (0.44%).

- This fund is suitable for investors looking to invest for at least 3 years and looking for high return as well. However, investors must keep in mind the possibility of risk.

|

| Image(Screenshot) from Moneycontrol |

4. DSP Credit Risk Fund

- Net Asset Value (NAV) of DSP Credit Risk Fund is Rs. 29.6173 (24 Sept.2020) with the fund size of Rs. 338.54 Cr.

- Fund House: DSP Mutual Fund

- Having investment of 52.05% in debt, out of which 43.5% is in funds that are invested in very low risk securities.

- The rest 47.95% is TREPS (36.76%) and Net Receivables (11.19%).

- This fund is suitable for investor looking for long duration investment and less risk investment.

|

| Image(Screenshot) from Moneycontrol |

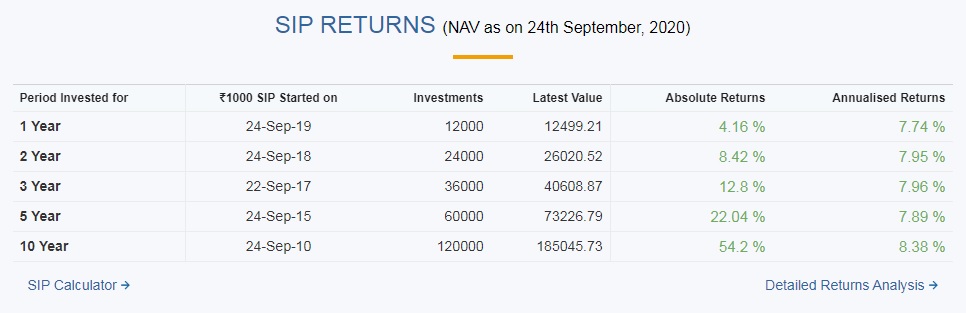

5. ICICI Prudential Bluechip Fund

- ICICI Prudential Bluechip Fund is Large Cap Fund by ICICI Prudential Mutual Fund with Net Asset Value (NAV) of Rs. 39.28 (24th Sept.2020).

- Size of this fund is Rs. 24365.05 Cr.

- Fund is having 97.07% investment in Indian Stocks out of which 82.03% in large cap stocks, 4.33% in mid cap stocks, 0.95% in small cap stocks. Fund also has 1.16% investment in Debt out of which 1.08% in Government securities, 0.08% in funds which are invested in very low risk securities.

- Rest of 3.02% is TREPS (1.51%), Net Receivables (1.29%), Margin (0.17%), FD of HDFC Bank ltd. (0.04%)

- This fund is suitable for investors looking for investing for at least 3-4 years. At the same time, investors must keep in mind the possibility of risk.

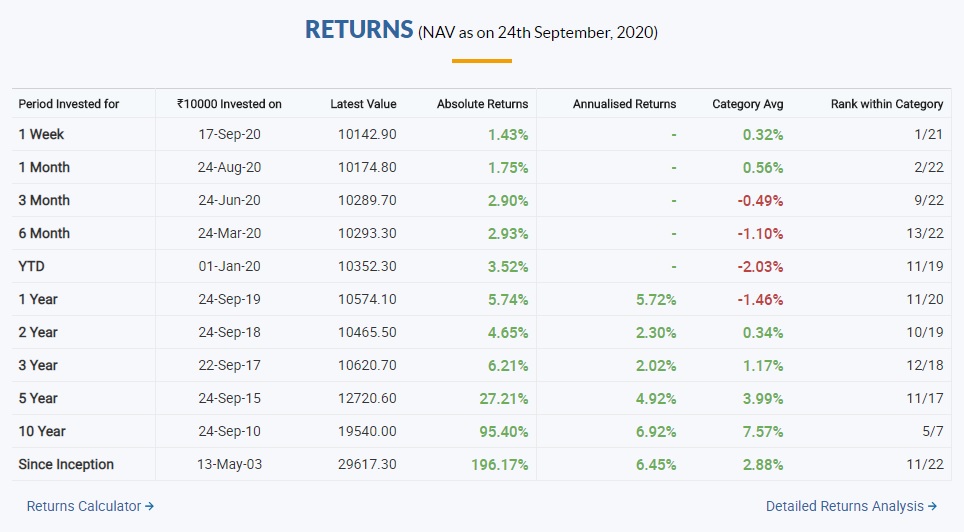

Information of Returns on this fund is provided below:

|

| Image(Screenshot) from Moneycontrol |

|

| Image(Screenshot) from Moneycontrol |

However, an investor must choose a mutual fund on his own by keeping in mind various factors like personal goals, risk tolerance, type, style and size of funds, evaluation from past etc.

Disclaimer: The information given above is for educational purpose only. We do not recommend or promote any product or service.

0 Comments

We encourage respectful and relevant comments. Thank You!

Emoji